Let your card help you to save for a better living.

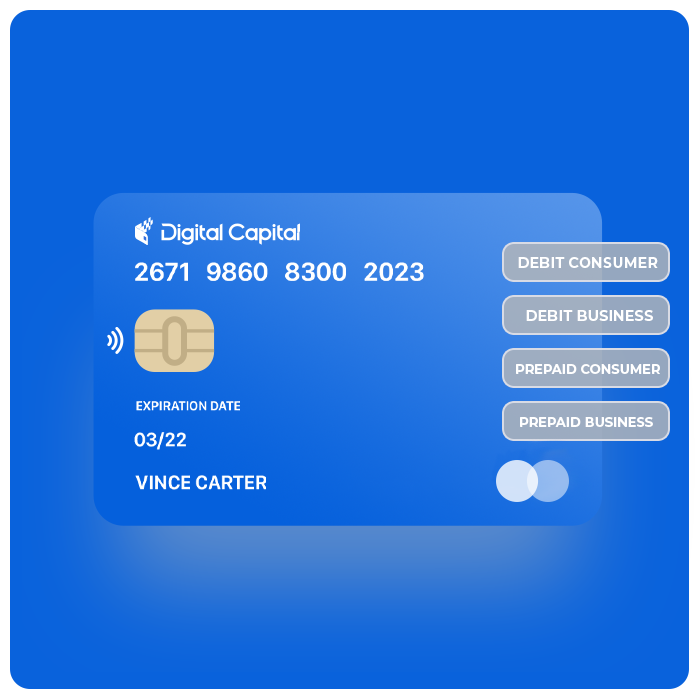

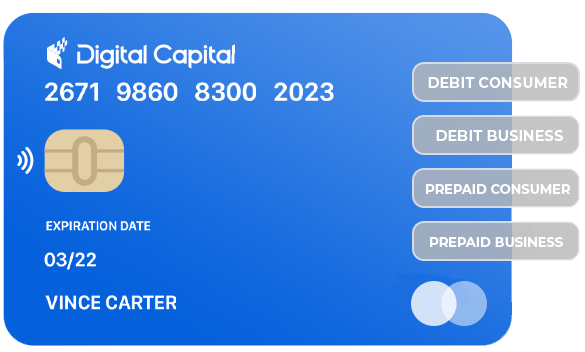

We enable our Clients to issue Mastercard debit and/or prepaid card. Cards can be issued to consumers or business, and are available as physical cards or virtual cards, both of which can be managed within the system.

For Clients who do not have their

own brand but would like to issue

cards under one of existing Digital

Capital’s brands.

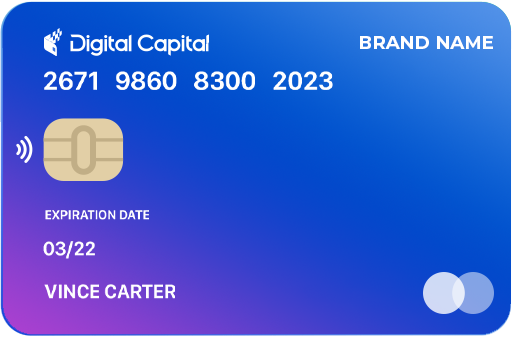

This option enables Client to have

together with Digital Capital’s

branding their own brand logo/name

on the card.

For those who already have

established brands this is the best

option enabling cards to be fully

branded according to Client’s wishes.

Cards can be activated within the app as soon as they are ordered and are ready to use for online and offline purchases or ATM withdrawals.

Customers can view their current PIN or/and change card’s PIN within the app with just few clicks. No need for ATM or calling the back to get new PIN

If customer thinks its card has been lost or stolen it can report this within the app and card will be instantly blocked in that way keeping funds safe.

If customers want to use prepaid cards with limited amounts available, they can easily top-up prepaid cards within the app anytime and use it as any other card.

If you are looking for a reliable payment partner, that prioritise Client`s needs and innovative approach contact us to see how we can help your business thrive.

Digital Capital Ltd is a company registered in England and wales {No. 10222334}. Digital Capital Ltd is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011, Firm References 900710.

© All rights reserved by Digital Capital